Expanding Investor Universe

The Wealth Channel: The Search for Diversification

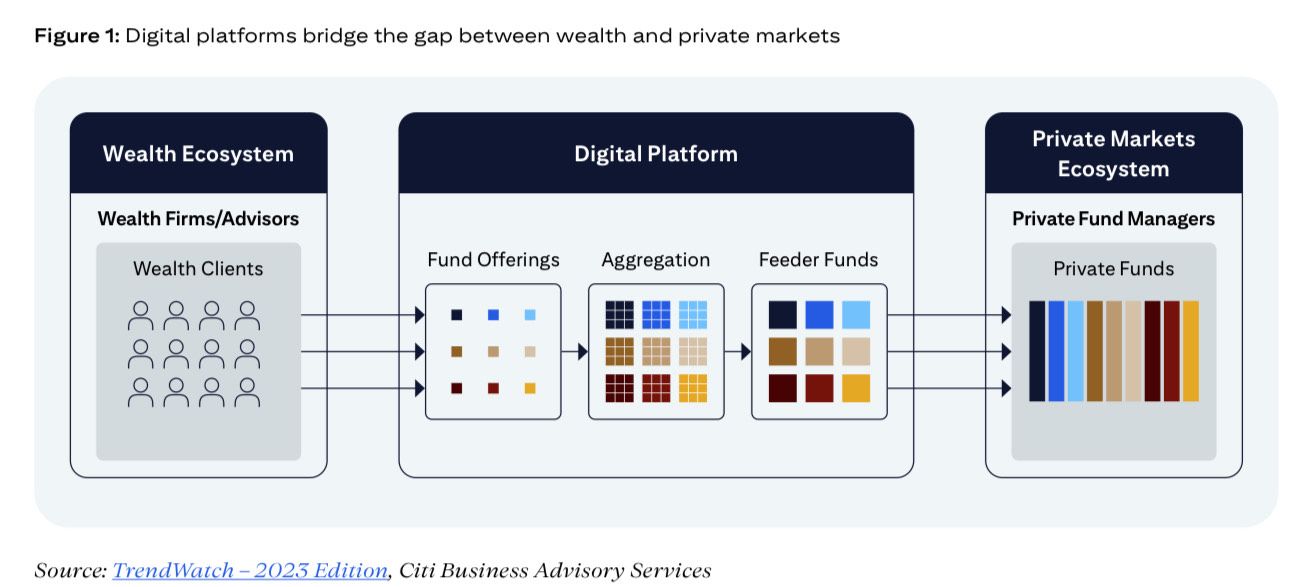

Wealthy individual investors have been increasingly allocating to private markets as they seek to diversify their portfolios and tap into potentially higher returns versus public markets. In a 2025 survey by Blackstone, 68% of advisers surveyed said they planned to increase their allocations to private markets. Adding private markets products could help advisers and wealth managers to deepen client relationships and attract new clients. The expansion of wealth capital in private markets brings significant opportunity, but it also introduces potential complexity for GPs whose business models were designed for institutions with large investments and human-centric client services. GPs may need to transition to a hybrid client services model that strikes a balance between institutional and individual investors. This transformation is creating opportunities for innovation and service provision in areas such as education and advisory, technology and operations, product design, and distribution. A new breed of digital platform connecting financial advisers and wealth investors to private markets funds has emerged (figure 1). These marketplaces typically pool commitments in feeder funds and streamline the distribution process, removing the burden from the GP and reducing investment minimums. Interviewees discussed working with these channels, as well as partnering with banks, wealth managers and other third-party distributors to tap into the wealth market.

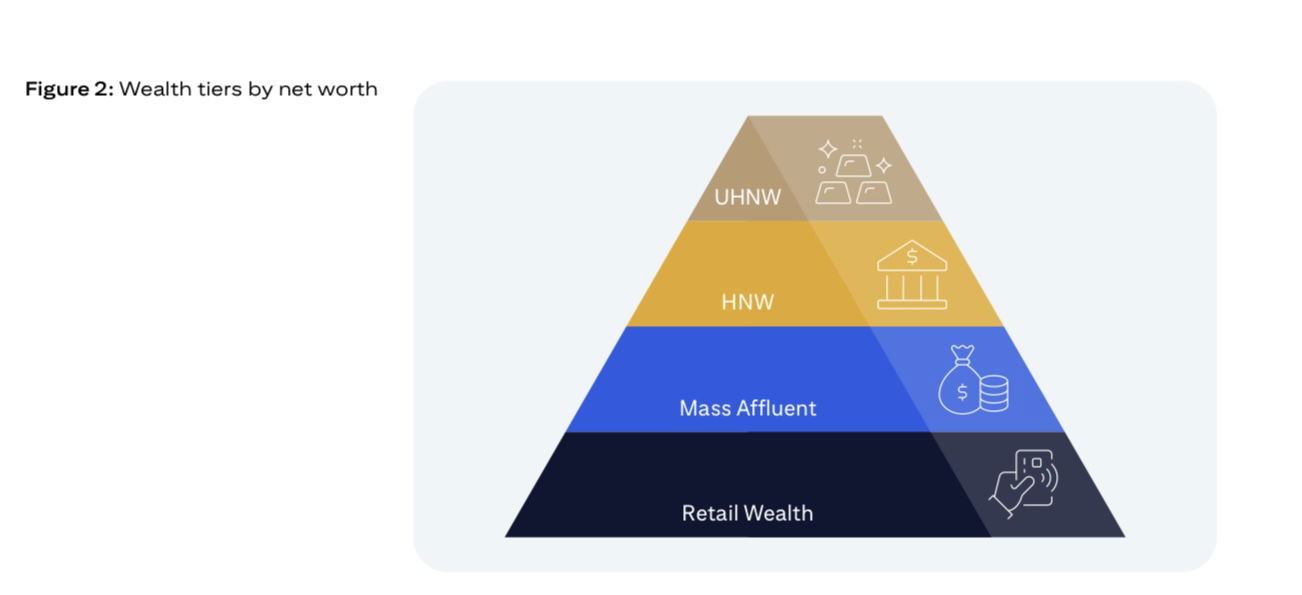

GPs are also focusing on improving their retail capabilities, requiring a rethink of their product and technology offering. Those that already have wealth franchises may have a head-start, but will still need to figure out how to integrate public and private investments into a single client experience. Interviewees were hesitant to make private market opportunities available directly to consumers. Instead, they are focused on wealth management clients – typically high-net-worth (HNW) or ultra-high-net-worth (UHNW) investors (figure 2). There is ongoing discussion about making private markets more accessible to the mass affluent and even retail segments through brokerages and other direct-to-consumer platforms or self-directed pension plans.

In the last ten years, assets in defined-contribution (DC) pensions across seven major pension markets (Australia, Canada, Japan, Netherlands, Switzerland, UK and U.S.) have increased by 6.7% a year, compared to 2.1% for defined benefit (DB) assets.8 DC now represent 59% of the $53.5 trillion total pension assets of these countries (year-end 2024 estimate), versus 43% of total assets in 2009. In Australia, which introduced auto-enrolment in 2012, DC makes up 89.2% of the total. The country’s superannuation funds have a strong track record of allocating to private markets. DC pension plans have come into focus in other jurisdictions too. In August 2025, U.S. President Donald Trump signed an executive order that may reduce barriers to DC plans investing in alternatives, including private assets. This could represent a capital influx to private markets from the $12.5 trillion U.S. DC market. In the UK, the Mansion House Compact was signed in 2023 by 11 pension plan signatories, committing to allocate 5% of fund.

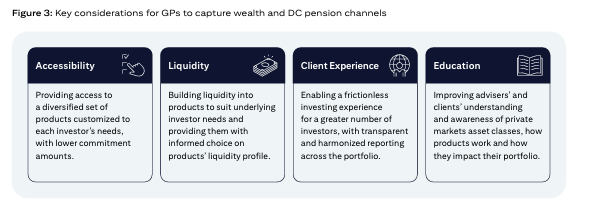

Similar to wealth management clients, DC pension funds also have different requirements from institutional investors. For example, they may be more sensitive to fees and have regulatory restrictions. In the UK, DC pension schemes have a charge cap of 0.75% as a percentage of total funds or a combined charge that is broadly equivalent. One important constraint is the need for the kind of liquidity provided by public markets. Individual investors may also demand such liquidity from private assets. Transparent and reliable reporting will also be important to ensure investors understand valuations and returns in the context of their overall portfolio. Regulators are considering guardrails, with the UK’s Financial Conduct Authority (FCA) highlighting the importance of consumers being able to make informed decisions. In the U.S., the Investor Advisory Committee (IAC) has proposed recommendations to the Securities and Exchange Commission (SEC) on how registered funds can enable investing into private markets, including additional investor protections and changes to disclosures. GPs could provide educational resources to help DC providers and wealth advisers understand private markets, including guidance on fund structures, fee mechanics, asset classes, and overall portfolio construction (figure 3). In addition, ensuring fair access to opportunities across investor type and size will need to be monitored, with some concern that higher quality funds or assets may not be accessible for all.

In Summary, TBC Can Help You and Your Business With it All.

In Summary, TBC Can Help You and Your Business With it All.

More investor categories are pursuing private-market exposure:

Wealth clients

High-net-worth individuals

Digital-platform users

Defined-contribution retirement plans

Barriers are falling in the markets, and we are in the middle of it all.

Simplified product structures

Digital onboarding

Lower minimums

Enhanced transparency

Better data and reporting standards